How to Practice Intentional Spending

Modern life is filled with constant temptations to spend. From online ads to one-click purchases, it’s increasingly easy to buy things we don’t need. But more than ever, practicing intentional spending is essential to building financial security and a meaningful life. In this guide, we will break down how to align your spending habits with your values, reduce regret, and gain control over your finances.

TL;DR – Intentional Spending in a Nutshell

Intentional spending means making mindful, value-driven decisions about where your money goes. It’s about prioritizing what really matters in your life and cutting out impulse or wasteful purchases. This doesn’t mean never spending, but spending smartly, with purpose. By creating awareness and aligning spending with goals, you can achieve both financial freedom and peace of mind.

What Is Intentional Spending?

Intentional spending is the practice of using your money in ways that support your goals, reflect your values, and bring you genuine satisfaction. Contrary to popular belief, it’s not just about saving—it’s about spending better.

When you spend intentionally, you’re not just reacting to wants or societal pressures. Instead, you proactively decide where your resources should go. This kind of spending nurtures long-term financial health and reduces buyer’s remorse.

Why Intentional Spending Matters

In a consumer-driven world, many people face the trap of living paycheck to paycheck—not because they don’t earn enough, but because of unconscious spending patterns. Intentional spending helps to undo those patterns. It gives you tools to:

- Improve financial stability by reducing waste and unnecessary expenses

- Build meaningful habits that align with personal and financial goals

- Avoid debt and increase savings by exerting control over spending

- Gain emotional satisfaction from spending that serves a greater purpose

The shift to intentionality is not only about money—it’s about reclaiming your time, values, and peace of mind.

Steps to Practice Intentional Spending

Here’s a step-by-step approach to help you adopt intentional spending in your daily life:

1. Define Your Core Values

First, get clear on what matters most to you. For example, ask yourself:

- What brings me the most joy and fulfillment?

- What causes or communities do I care about?

- What kind of life do I want to build?

Your answers will form the foundation for how you allocate your financial resources. For some, investing in education or travel may align with their goals. For others, saving for retirement or supporting family may be more meaningful.

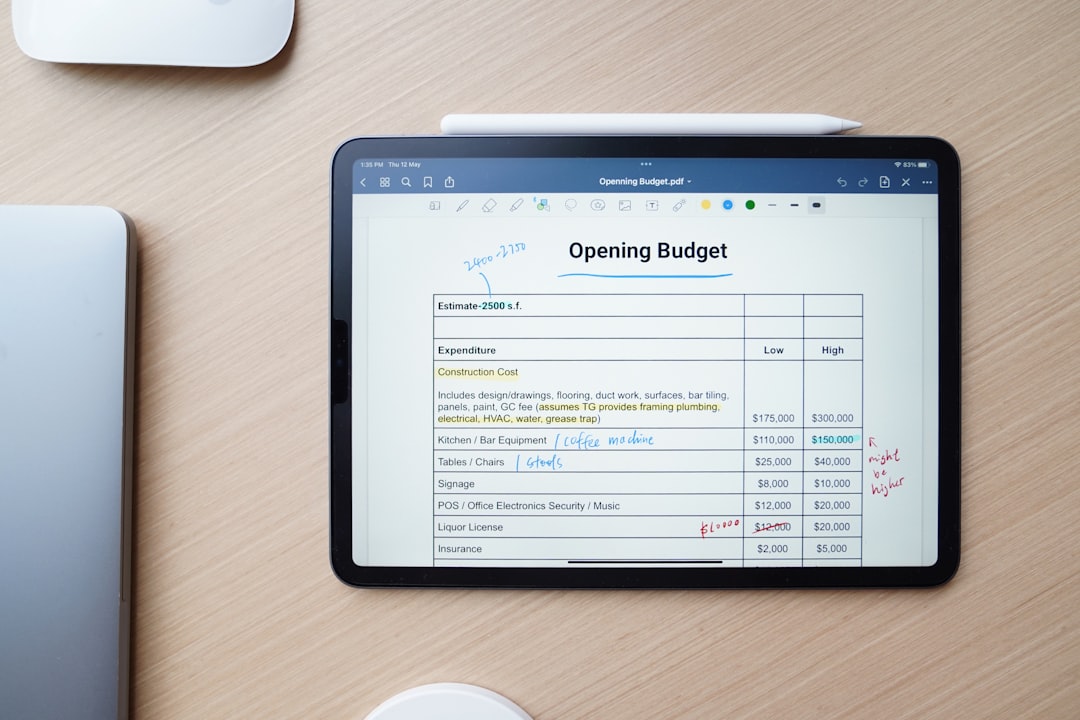

2. Track Your Spending

You can’t change what you don’t measure. Tracking your expenses helps uncover where your money is currently going—and often it’s not where you think. Use a budgeting app, spreadsheet, or even notebook to see:

- Where you consistently spend the most money

- Which purchases were impulse buys

- Which expenses brought real satisfaction versus temporary pleasure

Even a few weeks of tracking can reveal habits that need adjusting. Awareness is step one in becoming a more intentional spender.

3. Create a Value-Based Budget

Now that you understand your priorities and expenses, create a budget tailored to your values. This doesn’t mean rigid restrictions—it means purpose-driven allocations. For example:

- If fitness and health are important, budgeting for a quality gym or organic groceries makes sense.

- If family time is a priority, fund outings or activities that support connection.

- Cut or limit spending on categories that don’t align with your bigger picture.

The goal is to spend without guilt where it matters, and to reduce waste where it doesn’t.

4. Institute a Waiting Period

A powerful tactic for curbing spontaneous or unintentional buying is the “48-hour rule.” Here’s how it works:

- When you want to buy something non-essential, wait 48 hours before purchasing.

- Reconsider whether it truly adds value to your life.

- In many cases, the initial urge will pass—and you’ll avoid a regretful expense.

This simple delay can protect your finances from emotional or impulsive decisions, leading to more thoughtful purchases over time.

5. Use Cash or Debit Instead of Credit

Swiping a credit card often distances you psychologically from the act of spending. Try using debit cards or even cash for discretionary purchases. Studies have shown that physically parting with money makes people think twice before buying.

If you use credit cards, consider setting strict limits and paying the balance off in full each month to prevent debt accumulation.

6. Automate Needs, Intentionally Choose Wants

Automate recurring, non-negotiable essentials like rent, utilities, retirement contributions, and savings. This makes sure your needs are always met. For discretionary spending, keep it manual so each dollar is a deliberate choice.

This separation ensures your foundation is secure while allowing you the freedom to enjoy guilt-free spending in other areas.

Common Pitfalls to Avoid

While practicing intentional spending, watch out for these common mistakes:

- Confusing deprivation with discipline: Intentional spending isn’t austerity—it’s about enjoyment with awareness.

- Social comparison: Avoid basing your spending habits on what others are doing. Their values may be different from yours.

- Ignoring emotional triggers: Identify what drives your spending—stress, boredom, status-seeking—and find healthier outlets.

- Chasing discounts: Buying things just because they’re on sale isn’t necessarily intentional. Ask yourself if you’d still want it at full price.

Benefits of Intentional Spending

The shift toward intentional spending offers both short- and long-term advantages. These include:

- Better financial health: Less debt, more savings, and greater resilience in emergencies

- Clarity and peace of mind: Knowing that your spending supports your goals brings emotional relief

- Improved relationships: Money-related stress often harms relationships; intentionality fosters openness and trust

- Freedom and flexibility: When you spend with purpose, you’re less burdened by stuff and more able to pivot your life plans

Final Thoughts

Intentional spending is not a one-time fix—it’s an ongoing practice that requires reflection, honesty, and commitment. Over time, however, it becomes easier and more rewarding. Each purchase turns into a conscious decision rather than a reflex, giving you a stronger sense of control over your life and finances.

Start small, track consistently, and stay anchored to your values. You don’t need to be perfect; you only need to stay intentional. In the long run, this mindset will not only improve your financial outlook but also deepen your sense of purpose and fulfillment.

Money is a tool. Use it with intention.

- How to Practice Intentional Spending - January 1, 2026

- Wired Block: Blockchain Developments - January 1, 2026

- How to Fix Roblox ‘Content Not Accessible’ Error? - January 1, 2026

Where Should We Send

Your WordPress Deals & Discounts?

Subscribe to Our Newsletter and Get Your First Deal Delivered Instant to Your Email Inbox.